Page 39 - Policy Economic Report_Feb'25

P. 39

POLICY AND ECONOMIC REPORT

OIL & GAS MARKET

The Singapore gasoil crack spread eased with higher Chinese exports leading to higher gasoil availability

in Singapore. Additionally, weaker demand from Europe amid a tight arbitrage, a weak cross-regional price

spread and stronger freight rates further contributed to weaker Asian gasoil margins. The Singapore gasoil

crack spread against Dubai averaged $14.26/b, down by $1.23, m-o-m, and $8.17, y-o-y.

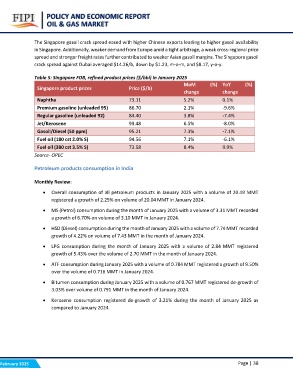

Table 5: Singapore FOB, refined product prices ($/bbl) in January 2025

Singapore product prices Price ($/b) MoM (%) YoY (%)

change change

0.1%

Naphtha 73.11 5.2% -9.6%

-7.4%

Premium gasoline (unleaded 95) 86.70 2.1% -8.0%

-7.1%

Regular gasoline (unleaded 92) 84.40 3.8% -6.1%

9.9%

Jet/Kerosene 93.48 6.5%

Gasoil/Diesel (50 ppm) 95.21 7.3%

Fuel oil (180 cst 2.0% S) 94.56 7.1%

Fuel oil (380 cst 3.5% S) 73.58 8.4%

Source- OPEC

Petroleum products consumption in India

Monthly Review:

• Overall consumption of all petroleum products in January 2025 with a volume of 20.49 MMT

registered a growth of 2.25% on volume of 20.04 MMT in January 2024.

• MS (Petrol) consumption during the month of January 2025 with a volume of 3.31 MMT recorded

a growth of 6.70% on volume of 3.10 MMT in January 2024.

• HSD (Diesel) consumption during the month of January 2025 with a volume of 7.74 MMT recorded

growth of 4.22% on volume of 7.43 MMT in the month of January 2024.

• LPG consumption during the month of January 2025 with a volume of 2.84 MMT registered

growth of 5.43% over the volume of 2.70 MMT in the month of January 2024.

• ATF consumption during January 2025 with a volume of 0.784 MMT registered a growth of 9.50%

over the volume of 0.716 MMT in January 2024.

• Bitumen consumption during January 2025 with a volume of 0.767 MMT registered de-growth of

3.03% over volume of 0.791 MMT in the month of January 2024.

• Kerosene consumption registered de-growth of 3.21% during the month of January 2025 as

compared to January 2024.

February 2025 Page | 38