Page 31 - Policy Economic Report - September 2024

P. 31

POLICY AND ECONOMIC REPORT

OIL & GAS MARKET

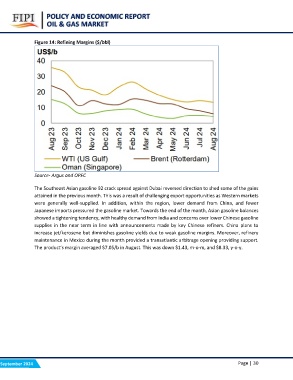

Figure 14: Refining Margins ($/bbl)

Source- Argus and OPEC

The Southeast Asian gasoline 92 crack spread against Dubai reversed direction to shed some of the gains

attained in the previous month. This was a result of challenging export opportunities as Western markets

were generally well-supplied. In addition, within the region, lower demand from China, and fewer

Japanese imports pressured the gasoline market. Towards the end of the month, Asian gasoline balances

showed a tightening tendency, with healthy demand from India and concerns over lower Chinese gasoline

supplies in the near term in line with announcements made by key Chinese refiners. China plans to

increase jet/kerosene but diminishes gasoline yields due to weak gasoline margins. Moreover, refinery

maintenance in Mexico during the month provided a transatlantic arbitrage opening providing support.

The product’s margin averaged $7.05/b in August. This was down $1.43, m-o-m, and $8.33, y-o-y.

September 2024 Page | 30