Page 32 - Policy Economic Report - September 2024

P. 32

POLICY AND ECONOMIC REPORT

OIL & GAS MARKET

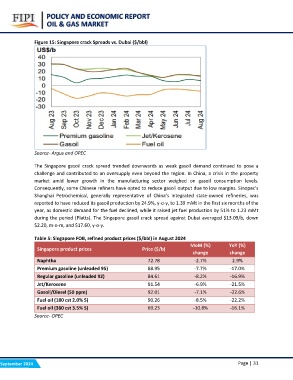

Figure 15: Singapore crack Spreads vs. Dubai ($/bbl)

Source- Argus and OPEC

The Singapore gasoil crack spread trended downwards as weak gasoil demand continued to pose a

challenge and contributed to an oversupply even beyond the region. In China, a crisis in the property

market amid lower growth in the manufacturing sector weighed on gasoil consumption levels.

Consequently, some Chinese refiners have opted to reduce gasoil output due to low margins. Sinopec’s

Shanghai Petrochemical, generally representative of China’s integrated state-owned refineries, was

reported to have reduced its gasoil production by 24.9%, y-o-y, to 1.39 mMt in the first six months of the

year, as domestic demand for the fuel declined, while it raised jet fuel production by 51% to 1.23 mMt

during the period (Platts). The Singapore gasoil crack spread against Dubai averaged $13.09/b, down

$2.20, m-o-m, and $17.60, y-o-y.

Table 5: Singapore FOB, refined product prices ($/bbl) in August 2024

Singapore product prices Price ($/b) MoM (%) YoY (%)

change change

2.9%

Naphtha 72.78 -2.7% -17.0%

-16.9%

Premium gasoline (unleaded 95) 88.95 -7.7% -21.5%

-22.6%

Regular gasoline (unleaded 92) 84.61 -8.2% -22.2%

-16.1%

Jet/Kerosene 91.54 -6.9%

Gasoil/Diesel (50 ppm) 92.01 -7.1%

Fuel oil (180 cst 2.0% S) 90.26 -8.5%

Fuel oil (380 cst 3.5% S) 69.23 -10.8%

Source- OPEC

September 2024 Page | 31